Main Content

Solid Solutions

To Serious Tax Problems

- • Income Tax Workouts

- • Responding to Notices

- • Business and Self-Employment Tax Problems

Practice Areas

Tax DisputesServing Clients Throughout Minnesota and Western Wisconsin

Tax DisputesServing Clients Throughout Minnesota and Western Wisconsin Small Businesses & Self EmployedServing Self-Employed Professionals And Independent Contractors

Small Businesses & Self EmployedServing Self-Employed Professionals And Independent Contractors Audits & AppealsServing Self-Employed Professionals And Independent Contractors

Audits & AppealsServing Self-Employed Professionals And Independent Contractors Outstanding BalancesExperienced Tax Attorneys in the Twin Cities, Minnesota

Outstanding BalancesExperienced Tax Attorneys in the Twin Cities, Minnesota

Experienced, Professional Counsel & Representation

Pridgeon & Zoss, PLLC provides clients throughout Minnesota and Western Wisconsin with solid solutions for their serious tax liabilities. If you’re facing an audit or the IRS is pursuing aggressive collection measures against you, we have the qualifications and experience to fight for a positive outcome. Clients come to us because they value our insights, perceptiveness, and fast understanding of their situations. We are confident that you will, too.

What Makes Us Different?

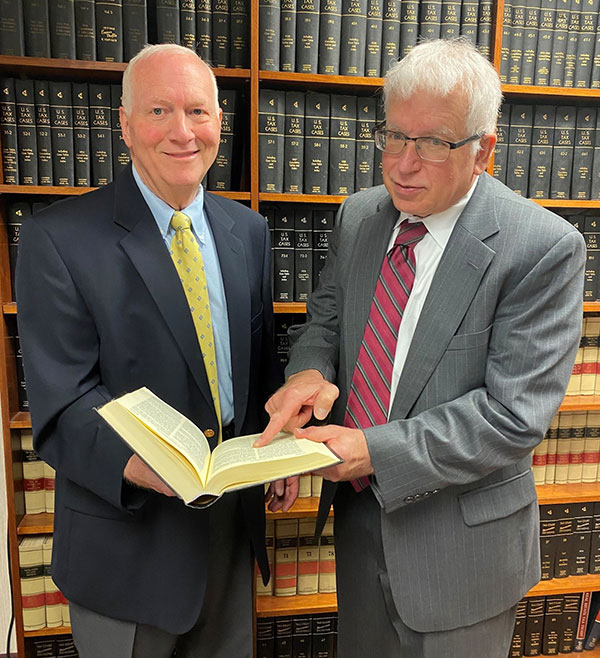

We are Minnesota’s most experienced Tax Controversy & Litigation Law Firm. At Pridgeon & Zoss, PLLC, we dedicate our practice to Minnesota state and federal tax law controversies. Our attorneys have a combined experience of over 80 years helping clients resolve major tax controversies with the IRS. Our integrity and commitment to finding the right solution for each unique case has earned our firm recognition from both tax officials and satisfied clients.

Attorney Mark Pridgeon is both an experienced tax attorney and certified public accountant, with over 40 years of direct experience as an IRS attorney, certified public accountant and advocate for taxpayers. He has taught a course in tax practice and procedure at the Carlson

School of Business at the University of Minnesota. His vast knowledge and diligent approach to his cases have earned him recognition as one of the Twin Cities area’s pre-eminent tax law attorneys.

Attorney Dave Zoss has a Master of Law degree in Taxation as well as over 40 years of professional experience as a licensed attorney, including nearly 30 years as an IRS litigation attorney. Dave has been involved in over 400 U.S. Tax Court cases. He led IRS trial teams in large and complex Tax Court trials. There are over 50 published Tax Court opinions in cases in which Dave was involved. As an IRS attorney, Dave taught training classes for IRS attorneys, revenue agents, and revenue officers. Dave has also taught law school-level federal tax classes and is a published author on tax and tax accounting issues. Like Mark, his legal skills, acumen, and experience have given him a widespread reputation as a successful tax lawyer.

Our Tax Law Practice Areas

In today’s climate of higher tax accountability, individuals, businesses, and organizations alike are facing greater scrutiny from the government and subject to civil and criminal penalties that are not often justified. At Pridgeon & Zoss, PLLC, we have the legal knowledge, negotiating skills, and trial experience required to protect your rights and your future.

Our practice areas include:

- Tax Disputes: Just because an IRS or Minnesota Department of Revenue auditor says you owe additional tax, doesn’t mean the auditor is correct. If you dispute the amount of your Minnesota or federal tax liability, we will recommend appropriate relief options that may include tax settlements, reduction of penalties, and tax appeals and litigation when necessary.

- Liability for Uncollected Taxes: If you are a business owner or corporate officer who has received notice that your personal and business returns are under review for unreported income or failure to pay sales taxes, talk to us about how to best respond to the notice.

- Business & Payroll Taxes: If you are a financial executive or business owner and have been contacted regarding taxes or your payroll trust fund taxes, call Pridgeon & Zoss, PLLC. We also support professional clients during corporate tax audits, litigation, and appeals, trust fund assessments, and independent contractor tax issues.

- Self-Employed: Self-employed professionals and independent contractors are routinely scrutinized by the IRS and the Minnesota Department of Revenue. If you are facing an audit or have already received a notice of additional taxes due, call us for advice and representation.

- Outstanding Balance Resolution: If you have an outstanding tax liability of $20,000 or more, we help you identify and pursue workable solutions such as IRS installment agreements, offers in compromise, having your debt declared uncollectible, or seeking innocent spouse relief if your spouse was responsible for underpaying taxes.

At Pridgeon & Zoss, PLLC, we understand how tax officials interpret and apply the law regarding income, deductions, and credits. We know that they sometimes overstep federal and state tax law, possibly leaving their disputed decisions open to appeal or litigation. We determine the relevant facts, consider all available options within the relevant law, and advise our clients regarding the best options for them to protect their interests.

-

Q. How can a Minnesota tax attorney help me with my tax issue?

No one should ever face the government alone. Attorneys Mark Pridgeon and David Zoss have successfully represented clients in tax disputes involving hundreds of thousands of dollars and more.

Our firm regularly works with tax authorities and appeals officers at the IRS and the Minnesota Department of Revenue. Upon reviewing your returns and records, we will give you an honest assessment of whether you have legitimate grounds to appeal the federal or state tax authority’s findings or can pursue litigation. You will know where you stand and how you can proceed.

-

Q. Is a CPA the same as a tax lawyer?

No, they are not the same. Although both deal with various aspects of taxation, their roles and skill sets are vastly different.

A CPA (certified public accountant) provides general accounting services and can prepare personal and business tax returns that accurately detail your financial circumstances.

Although many tax lawyers (including Mark Pridgeon) are CPAs, a lawyer goes a step further by understanding the administrative rules and laws that enforce the tax codes. They also understand how the IRS and Minnesota Department of Revenue interpret these laws and have the skills and training to protect client rights in adversarial proceedings, including negotiations with the IRS.

-

Q. Do you do tax returns?

As a renowned Twin Cities tax law firm, we often get questions about matters that aren’t included in our areas of practice, namely:

- Tax advice – There are plenty of resources online that answer basic questions, including both the IRS and Minnesota Revenue websites.

- Tax return preparation and filing. Please contact a qualified CPA in your area. We do not prepare tax returns. We can recommend return preparers if necessary.

- The IRS is being slow in issuing your tax refund or some other issue has come up with their processing of your tax return. We suggest that you contact the IRS Taxpayer Advocate’s Office and the similar office with the Minnesota Department of Revenue.

- Tax disputes with a former spouse. For example, your ex is wrongly claiming the children on their tax return.

About Pridgeon & Zoss, PLLC

Tax Law Representation For Businesses and Individuals In Minnesota And Western Wisconsin

If you are visiting our site, you are probably facing one of the most challenging legal issues of your life: a federal IRS or Minnesota Department of Revenue notice of significant taxes due. If you have received your first notice, don’t just lay it aside hoping the problem will go away. It won’t. In fact, the more urgently you respond to the notice, the more likely you are to achieve a favorable outcome. It may offer you some relief to know that you can even start making installment payments with the first notice. The tax officials often look a little more kindly on people who make an effort to set things straight right away.

If you have received a few of these notices, including letters sent by certified mail, you need legal help — now. The sooner you can meet with a qualified tax litigation attorney, the better off you will be. We have been working in the field of IRS and Minnesota tax law for more than 70 years combined. Our lawyers started working for the IRS.

Respected. Trusted. Experienced

When you work with Pridgeon & Zoss, PLLC, we give your case the attention it deserves. From beginning to end, you work only with us- we do not subcontract cases to other tax law firms. If you need to discuss your tax situation with an experienced Minneapolis tax lawyer, please call 952-835-8320. You may also contact us online.